Chinese stocks had their best day in years Wednesday as Beijing promised measures to “substantially” boost economic growth and keep financial markets stable.

Hong Kong’s benchmark Hang Seng (HSI) Index ended up 9.1%, the biggest one-day gain since October 2008. China’s Shanghai Composite also rallied 3.5%, the strongest gain for that index since July 2020.

Chinese stocks had suffered a huge sell-off in recent days, as investors worried about the country’s Covid lockdowns, regulatory actions against Chinese firms in China and the United States, and the potential for a backlash from Washington over Beijing’s close ties with Russian President Vladimir Putin.

The Nasdaq Golden China Dragon Index, a popular index tracking Chinese firms listed in the United States, plunged 12% on Monday, the most since 2002, according to Refinitiv Eikon. The index was down 25% in the past four trading sessions, after US regulators named five Chinese companies that could be removed from Wall Street for failing to meet audit requirements.

The Hang Seng Index had also tumbled 12% in the past three trading sessions to the lowest close in six years.

Following this battering, in a rare direct move to soothe investors’ nerves, Beijing on Wednesday vowed to maintain financial stability and bolster economic growth.

“We must implement the decisions and arrangements of central leadership, and substantially boost the economy in the first quarter,” a key government committee said in a statement cited by state-owned news agency Xinhua.

Government departments should “actively roll out policies that benefit the markets,” according to the statement from China’s financial stability committee chaired by Vice Premier Liu He, President Xi Jinping’s top economic advisor.

The statement also said Chinese and US regulators have achieved “positive progress” on the issue of US-listed Chinese stocks, and Beijing will continue to support Chinese IPOs abroad.

It said regulators should “complete” the crackdown on China’s major internet platform companies “as soon as possible.”

Authorities would also work towards tackling China’s real estate crisis, which last year saw the default of giant developer Evergrande.

“China’s top leaders finally broke the silence to respond to the recent market selloff,” wrote Larry Hu, chief economist for Greater China at Macquarie Group, on Wednesday. “The tone of the meeting is strong, suggesting that policymakers are deeply concerned about the recent market rout,” he said.

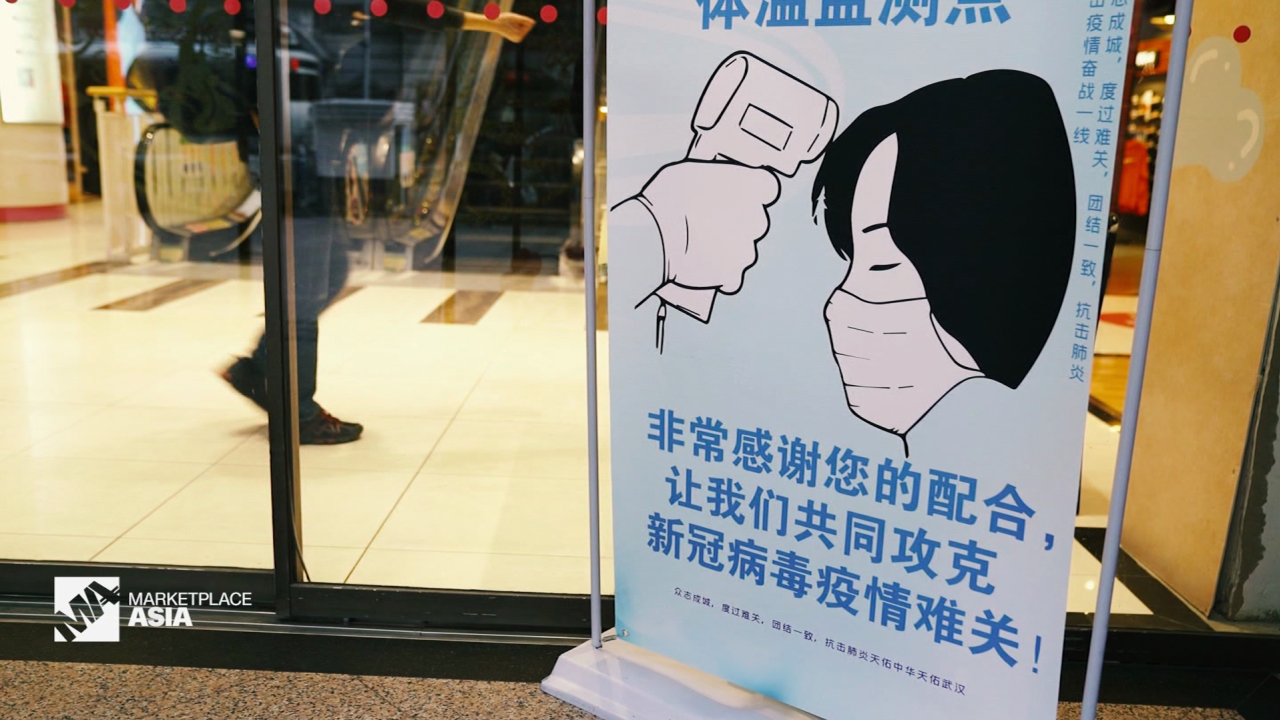

China also eased some Covid-related policies on isolation and testing on Tuesday, which helped to lift market sentiment.

Before the changes, positive cases needed to quarantine for 14 days even after two negative PCR tests. The new guidelines now allow for seven days of isolation at home after patients are discharged.

A drop in oil prices also helped markets globally on Wednesday. China is the world’s biggest importer of energy.

Oil prices fell overnight below $100 a barrel, fueling a stock rally on Wall Street that extended into Asia on Wednesday. Japan’s Nikkei and Korea’s Kospi rose 1.6% and 1.4% respectively.

— CNN’s Beijing bureau contributed to this report.